Payout Automation

In 2024, Alma was no longer able to process their volume of payouts through the old vendor. Dealing with a lot of UX debt and breaking internal processes, the team needed to move onto Stripe.

Role

Senior Product Designer

Timeframe

Apr – Sep 2024

Goal

Migrate 20,000 users to Stripe, replace existing payout onboarding, and unify disparate payout information

The business was encountering a three-fold problem.

Billing CSAT metrics were dropping.

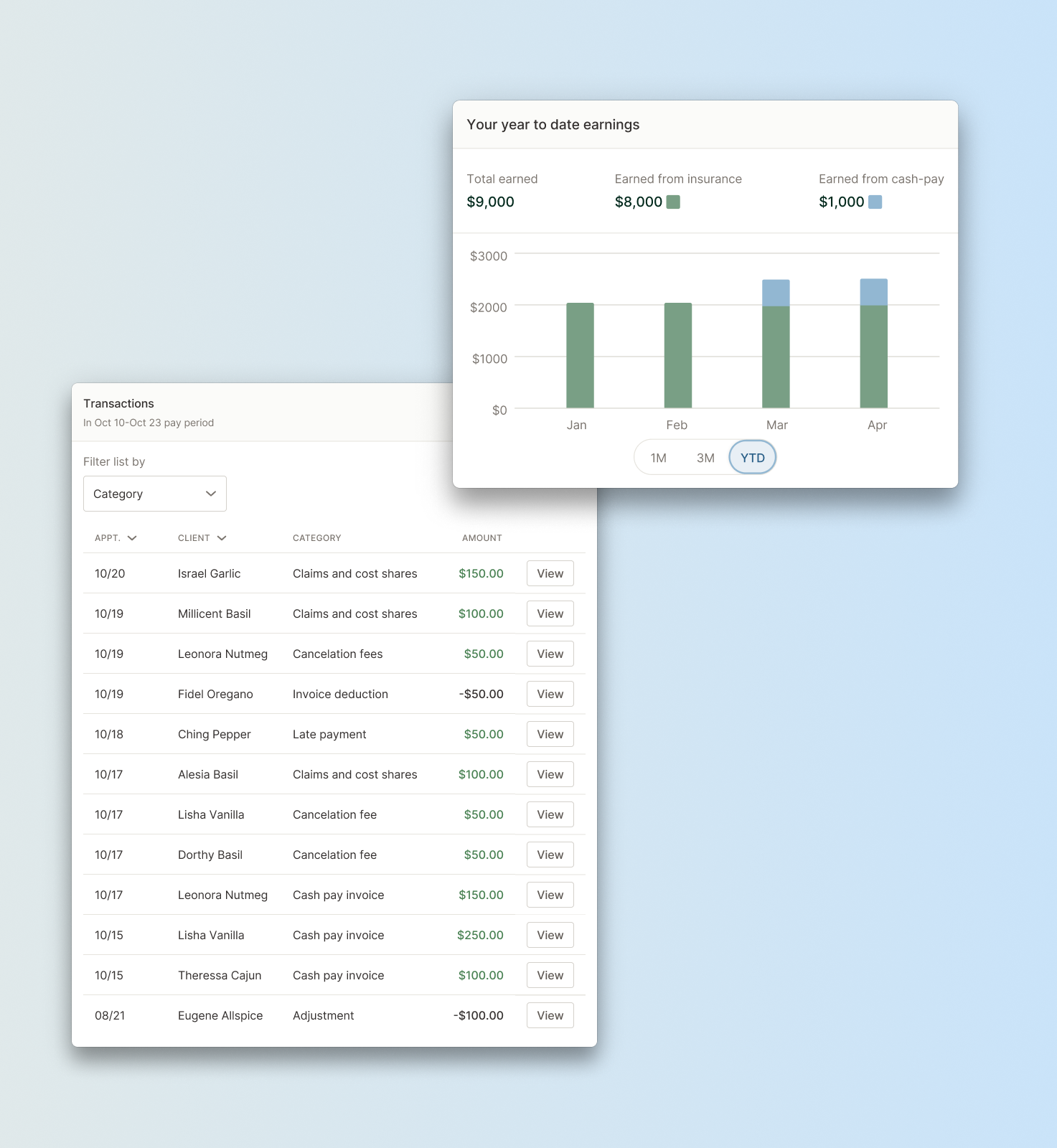

Providers tracked weekly payouts in a disjointed manner for private pay and insurance claims, adding to administrative burden and causing distrust in Alma’s payout system.

The manual burden was unsustainable.

It took the Accounting team 72 hours every weekend to process payouts. Uploads were prone to error and resulted in a lag (4 days) to deposit into bank accounts from when users were first alerted.

The existing process was failing at scale.

The existing system wasn’t secure enough for the volume of money moving on a weekly basis, and could no longer keep up. This continued debt led to issues for taxes YoY.

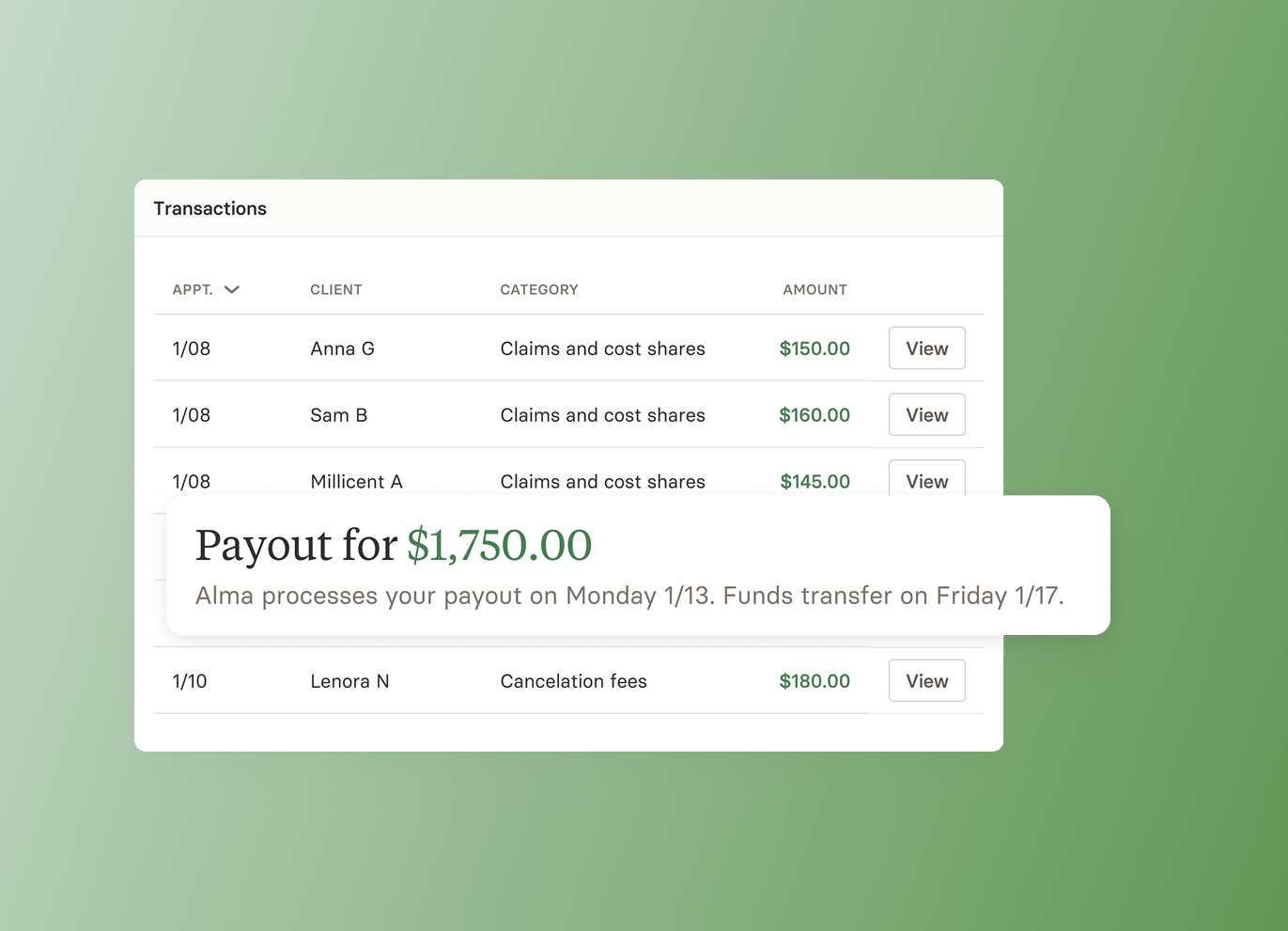

Once Manual Claim Adjustments were built, Alma was able to account for every dollar going in and out of a provider’s payout.

I redesigned the payouts page to reflect a provider’s mental model, and table-stakes.

“The new billing page is awesome. I like being able to see all payouts on one page. I love the payout breakdown. It’s a great flow and no longer choppy.”

— User feedback

“This is a great feature that significantly reduces the manual hours our team currently spend addressing provider queries since providers will now have immediate access to their payouts.”

— Alma CX team lead

Designing for a migration

I designed a migration for a 3 week rollover period. This was a net-new situation for Alma which required tight collaboration with Marketing, Enablement, and Customer Experience teams.

This project required a service design mindset and taking into account the highest-intensity touch points, e.g.

Choosing the correct tax identification for the private practice

Explaining the why to our provider base - a lot of this was internally driven, but we were expecting quicker and more accurate payouts

Because we aligned on a 3 week roll-over, we could warn in product in escalating urgency.

Week 1: Start with alert to set up Stripe – neutral, and make the needed information clear

Week 2: Bring out the warning styling – switch up the visual language to make the urgency known

Week 3: Error styling – make the repercussions clear to users

Stragglers: Lean on being disruptive with intention

Impact

100% of all active users made it onto Stripe seamlessly in 1 month.

Providers are getting paid within a day now, instead of 4.

The new process saves the Accounting team 72 hrs of manual work, week over week.