Autopay Design Strategy

In Nov 2024, Alma wanted to shift its entire service model – revisiting how the company considered client payment and figuring out how to prevent costly revenue losses.

Timeframe

Strategy: Nov – Dec 2024

Execution: Jan – Apr 2025

Goal

Align executive leadership on how to operationalize moving Alma’s Autopay to a required feature

Execute on the ideal solution

At the beginning of Q4 2024, Alma wanted to shift its service model.

Providers wanted Alma to handle billing and took issue with the deduction policy.

Alma’s deduction policy was unpopular, cited as the number one detractor on user NPS. Leadership wanted no more deductions on the platform by the end of 2025; but the business couldn’t just write everything off.

Claim write-offs were the leading source of revenue loss for the business.

When providers were escalated due to the deduction policy, Alma wrote-off the difference.

To shift the deduction policy, we needed client payment guardrails.

The product philosophy at the time was too flexible. We were facing a hard change. Leadership saw requiring Autopay as the best way to shift the service model without bleeding money.

The main ask was to define a way to require all clients to enroll in Autopay and maintain card validity.

If clients weren’t in good standing, Alma would build stronger product guardrails on the behalf of the provider.

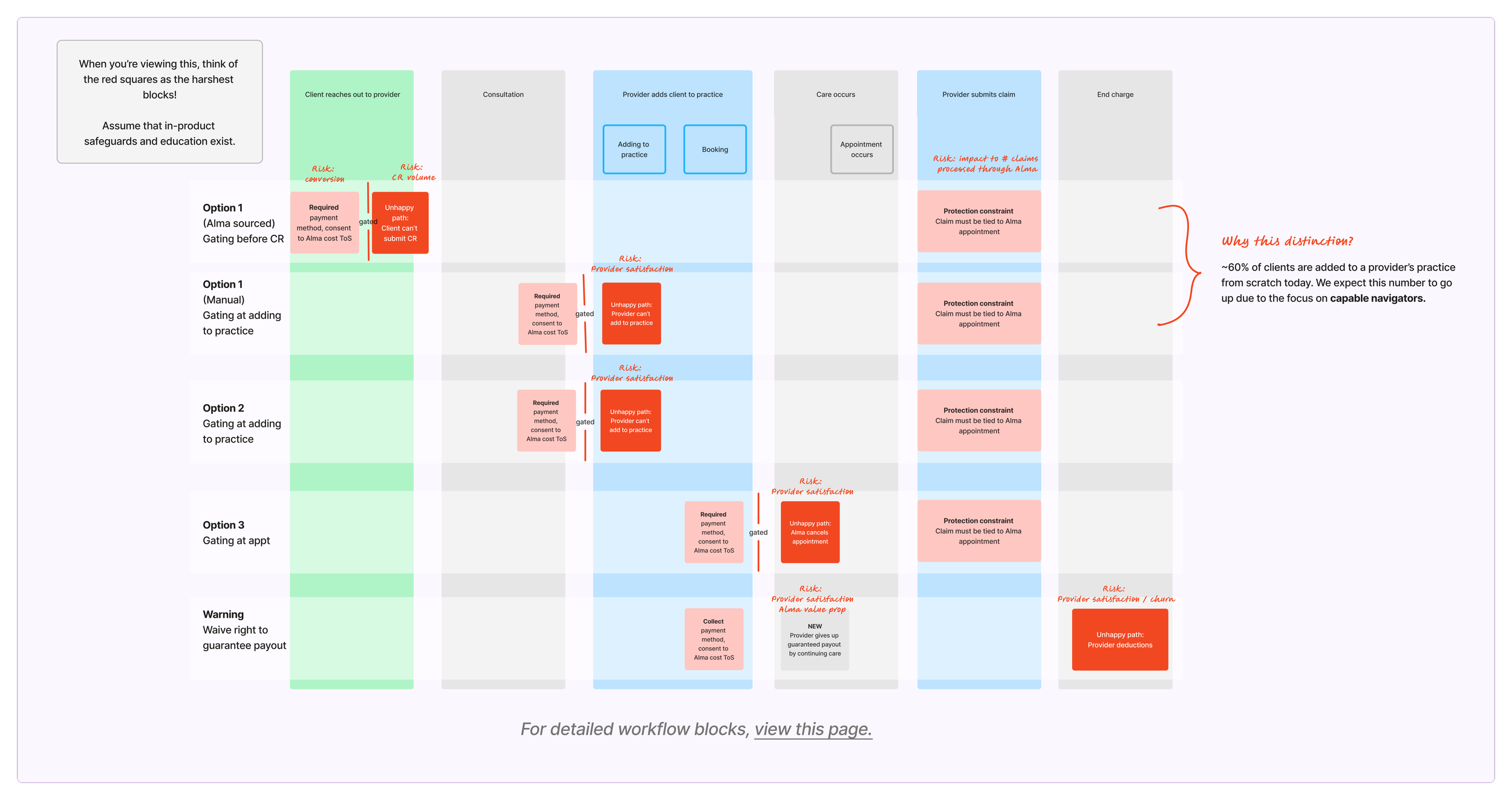

Round 1 Strategy

Guide stakeholders to answer:

In the product, where does Alma want to be strict vs. lenient?

Round 2 Strategy

Guide stakeholders to align on:

7 key product changes

Supported by data, financial estimates, and early technical discovery.

Impact of strategy

Brought a one-line policy to 7 product decisions/projects

Aligned executive leadership on an end-to-end Autopay shift

Set Billing Experience team up for execution into H1 2025

Execution

The project was planned for 2 phases. For Phase 2, where only new clients would see a product guardrails at intake, I led design.

For Phase 3, I led user research and client-facing designs.

Phase 2 Solution

I approached designs with these two high-level guiding questions:

Where does the product want to be lenient, and where does the product need stricter guardrails?

Where can I balance a change for the user vs. pain for the business?

User research

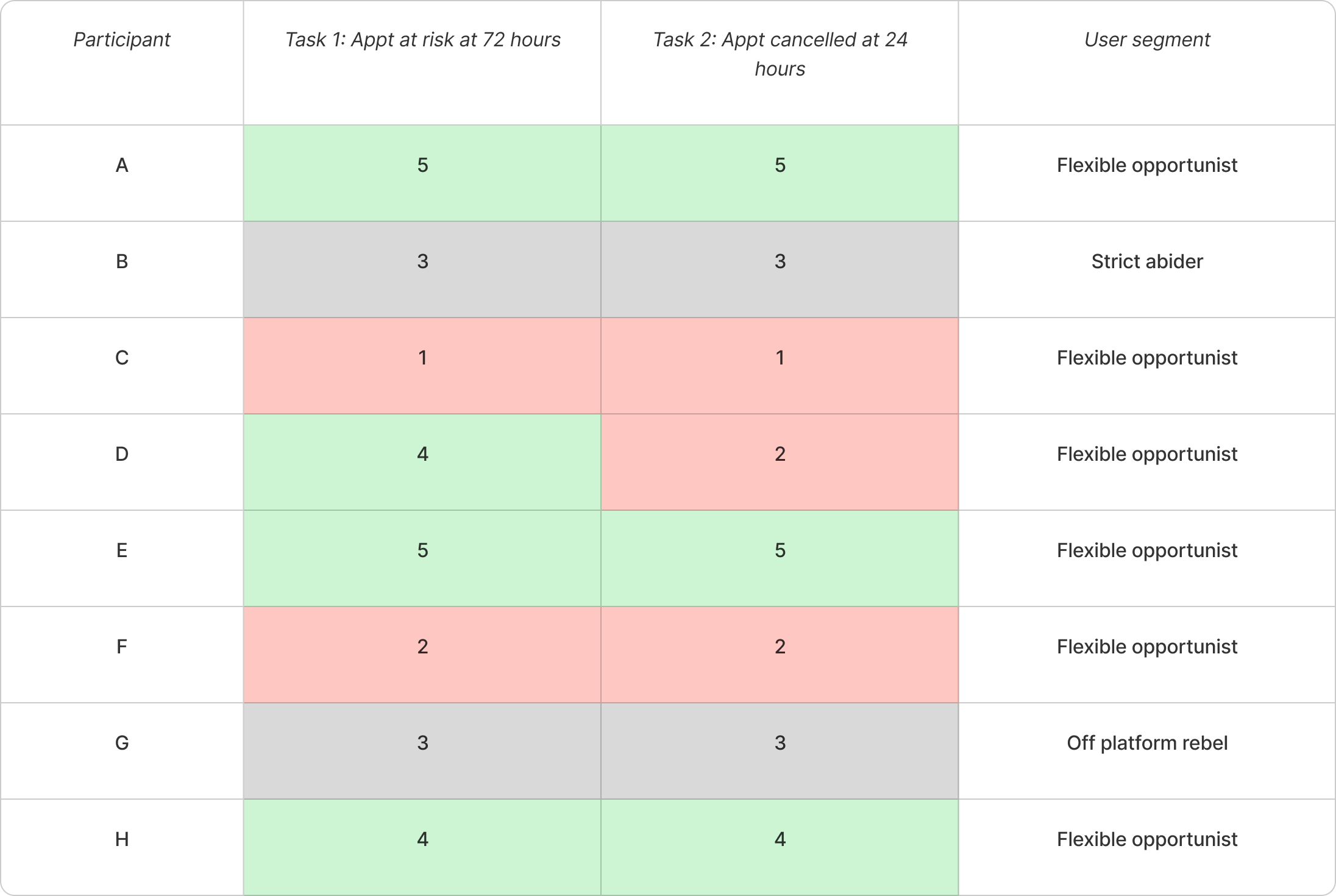

To test stricter product decisions and notification usability, I planned, conducted, and synthesized 45 min moderated interviews with 8 users in 3 days.

Through interviews I identified high risk to the part of the solution at appointment blocking. This led to a large product pivot which we aligned stakeholders on in < 1 week. Below are Likert scores for the two tasks participants were brought through. Usability was strong, but sentiment posed a big risk to the business.

Phase 3 Solution

The client facing design solution contended with 3 separate user platforms:

A client portal with 10% of the client base

A document portal for the other 90%

A separate invoice management system

The goal was to get clients to enroll in Autopay, and for any client with an unpaid invoice to pay.

Impact

Introduced HSA/FSA/HRA functionality for Autopay.

Phase 2 launched in May 2025. We’re actively tracking enrollment and unpaid invoice rates.